June 3, 2019

Each year Cast & Crew provides its clients with a summary of key changes in labor, employment and payroll-administration law. A few times during the year, we provide further important updates. While our “What’s New” series does not provide legal advice, it does seek to alert our clients to the myriad issues and challenges facing our industry in the new year.

Upcoming Employer Deadlines

- July 1, 2019 – Paid Family & Medical Leave in Massachusetts (see our previous post)

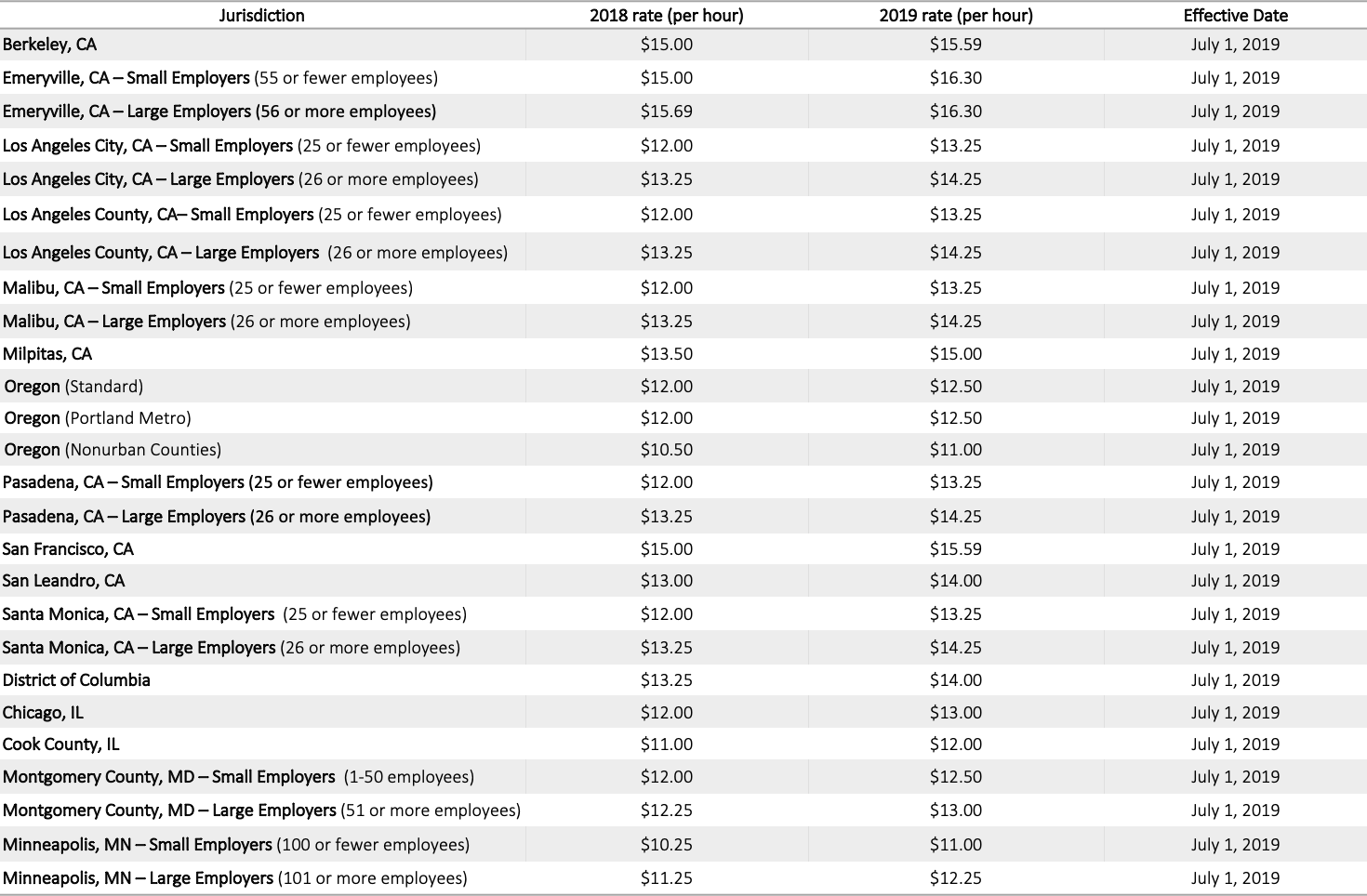

State & Local Minimum Wage Updates

Sick Leave Laws

Paid Sick Leave in Dallas, TX, Effective August 2019

In late April 2019, Dallas became the third city in Texas to pass a paid sick leave law. The law applies to Dallas employers with five or more employees. It allows employees to accrue paid sick leave hours at a rate of one hour for every hours worked, up to 48 or 64 hours per year, depending on employer size. Employees may use paid sick leave when they or a family member experience illness, injury, stalking, domestic abuse or sexual assault, or otherwise needs medical or mental health care. The law is scheduled to go into effect August 1, 2019, though it is expected to see challenges in court similar to the ordinances in Austin and San Antonio.

Additional information is available here.

Family Leave Laws

Paid Family and Medical Leave in Massachusetts, Effective July 2019

In 2018, the Massachusetts legislature passed the Paid Family & Medical Leave Law (“PFML”). The PFML program will provide paid time off to employees working in Massachusetts who need to care for their own or a family member’s medical condition, to bond with a child during the first 12 months of birth, adoption or fostering, or to tend to certain military-related events. The program is co-funded by employers and employees through payroll deductions. The total deduction rate is 0.63 percent of an employee’s annual earnings, subject to the social security cap, split between employer and employee. Deductions begin July 1, 2019 and benefits become available to employees beginning in January 2021.

Additional information on how Cast & Crew is helping its clients administer the program is available here and additional information on the law itself is available here.

State & Local Laws

Pregnancy Accommodation in Kentucky, Effective June 2019

On April 10, 2018, Governor Matt Bevin signed into law the Kentucky Pregnant Workers Act, which amends the Kentucky Civil Rights Act (“KCRA”) to require employers to provide reasonable accommodations for pregnancy or childbirth-related employee needs. Examples of reasonable accommodation under the law include longer or more frequent breaks, modified schedules or a lactation room (defined as a private space other than a restroom to express breastmilk). Employers may be exempt from providing certain accommodations if providing the requested accommodation would impose an undue hardship on the employer. The law goes into effect June 27, 2019.

Additional information is available here.

“Ban-the-Box” Legislation in New Mexico, Effective July 2019

New Mexico joins a growing number of states that have passed laws prohibiting employers from inquiring into a job applicant’s criminal history with its passage of The Criminal Offender Employment Act. The law prohibits employers from inquiring into an applicant’s arrest or conviction history. Employers are permitted to consider an applicant’s conviction record only upon discussion of employment with the applicant. The law goes into effect July 1, 2019.

Additional information is available here.

Salary History Ban in Washington, Effective July 2019

On May 9, 2019, Washington Governor Jay Enslee signed into law the Washington Equal Pay and Opportunities Act, which amends the state’s existing Equal Pay Act to add additional wage equality provisions. The Equal Pay and Opportunities Act prohibits most Washington employers from seeking information about the wage or salary history of an applicant, either from the applicant or his or her former employer. Employers may discuss wage or salary history when the applicant voluntarily discloses it or after an offer for employment has been extended. Penalties for violation may include civil actions, fines, damages, interest or reasonable attorneys’ fees and costs. The law goes into effect July 28, 2019.

Additional information is available here.

Salary History Ban in Maine, Effective Sept. 2019

On April 12, 2019, Maine Governor Janet Mills signed into law An Act Regarding Pay Equality. The law is aimed at combating wage inequality by prohibiting employers from inquiring into a prospective employee’s prior salary or compensation. The law also prohibits employers from preventing current employees from discussing their own wages with one another, thereby further enabling wage transparency. The law goes into effect Sept. 17, 2019.

Additional information is available here.

Wage Theft Statute Enacted in Colorado, Effective Jan. 2020

On May 16, 2019, Colorado Governor Jared Polis signed into law HB 1267, which imposes criminal penalties on employers who willfully refuse to pay wages or other compensation due to an employee. Under the new law, failure to pay an employee is classified as theft and may be penalized as a petty offense, a misdemeanor or a felony, depending on the amount of wages unpaid. Historically, Colorado employers who failed to pay employee wages may have been subject to fines, but no criminal liability. The law goes into effect Jan. 1, 2020.

Additional information is available here.

Salary History Ban Enacted in Cincinnati, OH, Effective March 2020

In March 2019, the City of Cincinnati joined a growing number of other jurisdictions in passing legislation aimed at closing the gender pay gap with The Prohibited Salary History Inquiry and Use Ordinance. The law prohibits Cincinnati employers, employment agencies or labor organizations from inquiring into an applicant’s salary history, screening applicants based on prior compensation or salary or relying on salary history when deciding to offer employment to an applicant. Employers are also prohibited from refusing to hire an applicant or retaliating against applicants who choose not to disclosure their salary history. The law allows applicants who have received a conditional offer of employment to reasonably request from the employer a “pay scale” for the job. The law goes into effect March 13, 2020.

Additional information is available here.

Pre-Employment Marijuana Testing Prohibited in New York City, Effective May 2020

On May 10, 2019, New York City Mayor Bill DeBlasio signed into law New York City Council Bill Int. 1445, which prohibits employers, labor organizations and employment agencies from testing prospective employees for marijuana as part of the employee hiring process. The law comes with a number of exceptions. Pre-employment marijuana testing is permitted for the following jobs: police or peace officers, construction workers, jobs that require a commercial driver’s license and jobs involving caretaking of children, medical patients or other vulnerable persons. The law also exempts union jobs when the governing collective-bargaining agreement discusses drug-testing policies for job applicants. No prohibition on drug testing of current employees is included in the law. The law goes into effect May 10, 2020.

Additional information is available here.

Mandatory Paid Time Off in Maine, Effective 2021

On May 28, 2019, Maine Governor Janet Mills signed into law the Earned Employee Leave Act (“EELA”). The EELA is the nation’s first paid leave mandate that allows employees use paid time off for any reason. The law applies to employers in Maine that employ more than 10 employees for more than 120 days in any calendar year. Covered employees accrue paid time off at a rate of 1 hour of paid leave for every 40 hours worked, up to 40 hours per year. Employees covered by a valid collective-bargaining agreement are not exempt from the law during the time between the law’s effective date through the expiration of the agreement. Though the law allows employees to take time off for any reason, employees are still required to provider their employers with reasonable notice when practicable. The law goes into effect Jan. 1, 2021.

Additional information is available here.

Mandatory Retirement Program Approved in New Jersey, Effective 2021

In late March 2019, Governor Phil Murphy signed into law the New Jersey Secure Choice Savings Program. The program is a state-administered Individual Retirement Account (“IRA”) aimed at providing retirement savings options for New Jersey employees who are not already offered retirement savings options through their employer. The program is entirely employee-funded through payroll deductions set at a default rate of three percent of annual wages. Employees are free to adjust the contribution rate and may elect not to participate. However, New Jersey employers with 25 or more employees who do not already offer retirement savings options to their employees are required to register and make the Secure Choice Savings Program available to eligible employees. The program goes into effect in 2021.

Additional information is available here.

Federal Changes

EEO-1 Component 2 Postponed Until Sept. 2019

Pursuant to an April 2019 order issued by Judge Tanya S. Chutkan of the United States District Court for the District of Columbia, the deadline for employers to submit Component 2 of the EEO-1 Report was postponed until Sept. 30, 2019. Component 2 of the Report contains pay data and salary information for an employer’s workforce. The new survey is expected to be available to employers beginning in July 2019. Component 1 of the report, which covers race, gender, ethnicity and gender, was due May 19, 2019.

Additional information is available here.

For further information, please contact Compliance@castandcrew.com.

—

The proceeding information is provided for informational purposes only, should not be construed as or relied upon as legal advice and is subject to change without notice. If you have questions concerning particular situations, specific payroll administration or labor relations issues, please contact your counsel.