December 3, 2019

Each year, Cast & Crew prepares a summary of key changes in the areas of labor, employment and payroll administration laws. Keeping up with the ever-changing marketplace is crucial to our company when it comes to providing services that our clients rely on. While our “What’s New” does not provide legal advice, it does seek to alert our clients to the myriad issues and challenges that arise in our industry.

Upcoming Deadlines

- Jan. 1, 2020 – New Federal W-4 (see our previous post)

- Jan. 1, 2020 – Taxation of California Resident Production Employees Working Out of State (see our previous post)

- Jan. 1, 2020 – AB 5 (see our previous posts, here and here)

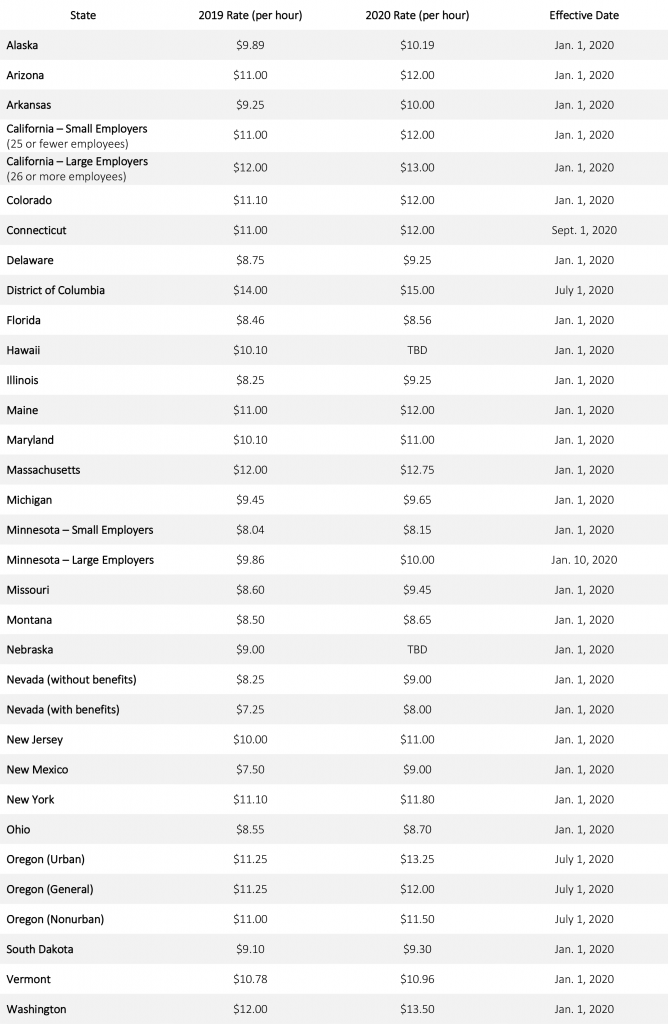

State Minimum Wage Increases

Local Minimum Wage Increases

Changes in California

Taxation of California Resident Production Employees Working Out of State, Effective Jan. 1, 2020

Senate Bill 271 amends the California Insurance Code to clarify ambiguity in the code, specifically with regards to entertainment production workers. Under the new law, California resident production employees working on projects out of state will contribute to unemployment insurance and state disability insurance to their resident state rather than their work state. This will make it easier for paid family lCalifornia resident production employees to access benefits. The law goes into effect Jan. 1, 2020. Additional information is available here.

New Test to Determine Employee vs. Independent Contractor, Effective Jan. 1, 2020

Assembly Bill 5 will change the way that certain workers are classified and paid in California, making it more difficult for employers to classify workers as independent contractors rather than as employees. The bill codifies the “ABC Test” adopted by the California Supreme Court in the Dynamex decision. This creates a presumption that workers are employees rather than independent contractors unless the employer can establish that the worker is free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract for the performance of the work and in fact; that the worker performs work that is outside the usual course of the hiring entity’s business; and that the worker is customarily engaged in an independently established trade, occupation, or business of the same nature as the work performed. The law goes into effect Jan. 1, 2020. Additional information is available here.

Limitations on Rehire Provisions in Employment Contracts, Effective Jan. 1, 2020

Assembly Bill 749 will prohibit so-called “no rehire” provisions in employment settlement agreements. Under the new law, provisions in a settlement agreement that prohibit an employee from obtaining future employment with the employer if the employee has filed a claim, will be void as a matter of law. The law only applies to agreements entered into after Jan. 1, 2020. Additional information is available here.

Mandatory Arbitration Provisions Prohibited in Employment Contracts, Effective Jan. 1, 2020

Assembly Bill 51 will prohibit employers from requiring employees and job applicants from waiving any rights established by the California Fair Employment and Housing Act (“FEHA”) or the Labor Code as a condition of employment. In practical terms, AB 51 prohibits employers from including provisions in employment contracts that mandate an employee or applicant to arbitrate claims of discrimination, harassment or wage and hour violations. The law only applies to agreements entered into after Jan. 1, 2020. Additional information is available here.

Expanded Lactation Accommodation Requirements, Effective Jan. 1, 2020

Senate Bill 142 will expand lactation accommodation requirements, imposing specific conditions for lactation rooms and prohibiting employers from retaliating against employees who assert their accommodation rights. Under the new law, lactation rooms must: not be a bathroom; be in close proximity to the employee’s work area; be shielded from view and free from intrusion and hazardous materials; be safe and clean; contain a surface to place a breast pump and personal items, a place to sit, and access to electricity; and have access to a sink with running water and a refrigerator suitable for storing milk. Limited exceptions exist for employers with fewer than 50 employees who can show that accommodations would pose an undue hardship on the business. The law goes into effect Jan. 1, 2020. Additional information is available here.

Statute of Limitations for FEHA Claims Extended, Effective Jan. 1, 2020

Assembly Bill 9 will extend the statute of limitations for claims brought under the Fair Employment and Housing Act (“FEHA”) from one year to three years. FEHA governs employee claims of discrimination and harassment, amongst others. The new laws apply to claims brought after Jan. 1, 2020. Additional information is available here.

Discrimination on the Basis of Hairstyle Prohibited, Effective Jan. 1, 2020

Senate Bill 188, also known as the CROWN Act (Create a Respectful and Open Workplace for Natural Hair Act), will prohibit discrimination on the basis of hairstyle and hair texture. The new law bans workplace dress codes and grooming policies that prohibit natural hair, including afros, braids, twists and locks. The law goes into effect Jan. 1, 2020. Additional information is available here.

Employment of Infants in the Entertainment Industry, Effective Jan. 1, 2020

Assembly Bill 267 will expand the application of existing California law that protects infants working in the entertainment industry by expanding the definition of “entertainment industry” beyond a movie set or location to include motion pictures, theater, television, photography, recording, modeling, rodeos, circuses, advertising, and any other performance to the public. The law goes into effect Jan. 1, 2020. Additional information is available here.

Paid Family Leave Expanded, Effective July 1, 2020

Senate Bill 83 will expand California’s existing Paid Family Leave benefit, allowing employees to take up to eight weeks off work (instead of six) to care for a seriously ill family member or to bond with a new child entering the family through birth, adoption or foster care placement. The new law goes into effect July 1, 2020. Additional information is available here.

Mandatory Anti-Harassment Training Postponed, Effective Jan. 1, 2021

Senate Bill 778 extends the deadline for the mandatory non-supervisor anti-sexual harassment training (a requirement created by last year’s Senate Bill 1343) from Jan. 1, 2020 until Jan. 1, 2021. The substantive requirements of the training remaining unchanged. Additional information is available here.

Changes in New York

New York Paid Family Leave Rate and Benefit Increases, Effective Jan. 1, 2020

On Jan. 1, 2020, New York state will enter its third year of the mandatory Paid Family Leave Program. NYPFL is entirely employee-funded through payroll deductions. In 2020, the contribution will be 0.270 percent of an employee’s gross wages each pay period, with a maximum annual contribution is $196.72. Eligible employees taking leave will receive 60 percent of their average weekly wage, up to a cap of $840.70. The new rates and benefits go into effect Jan. 1, 2020. Additional information is available here.

Salary History Ban, Effective Jan. 6, 2020

Senate Bill 6549 will prohibit employers from asking job applicants for wage or salary history, from relying on past wages to determine whether to make an offer of employment to an applicant, or from refusing to interview or hire someone based on prior salary or wages. Additional information is available here.

Expanded Protections for Freelancers, Effective Jan. 11, 2020

Int. 0136-A will expand the scope of the New York City Human Rights law to ensure that freelancers and independent contractors are protected by the Human Rights Law. Freelancers and independent contractors who experience harassment or discrimination based on their race, gender, sexuality, religion or any other protected category will be able to file complaints with the New York City Commission on Human Rights. The law goes into effect Jan. 11, 2020. Additional information is available here.

Pre-employment Marijuana Testing Prohibited, Effective May 10, 2020

Int. 1445-2019 will prohibit New York City employers from requiring a job applicant to test for marijuana as a condition of employment. There are certain exceptions for safety and security sensitive jobs, and jobs tied to a federal or state contract or grant. Additional information is available here.

Federal Changes

Social Security Taxable Wage Base Adjusted, Effective Jan. 1, 2020.

The Social Security (OASDI) taxable wage base, which governs the amount of pay subject to Social Security tax, is subject to adjustment annually. For 2020, the OASDI taxable wage base has been increased to $137,700. Additional information is available here.

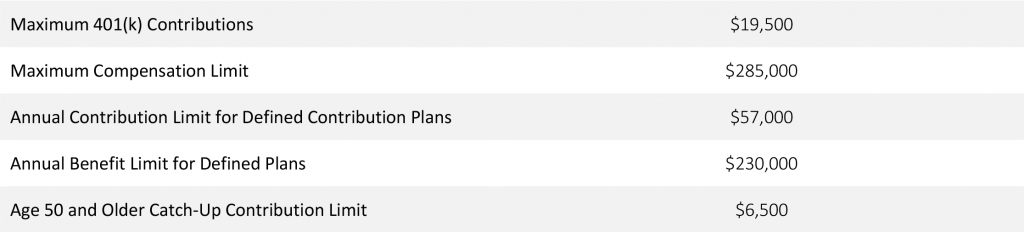

IRS Plan Limits Adjusted for 2020, Effective Jan. 1, 2020

The Internal Revenue Service has announced the 2020 limits that affect the operation of tax-qualified retirement plans, including 401(k) plans and other types of employee benefit plans. The following 2020 rate limits:

New Federal Overtime Rule, Effective Jan. 1, 2020

The United States Department of Labor recently announced a new final rule regarding eligibility for overtime pay for employees covered by the Fair Labor Standards Act (“FLSA”). The FLSA requires employers to pay minimum wage and overtime rates to employees unless they are exempt from those requirements. Effective Jan. 1, 2020, the federal final rule raises the salary threshold to $684 per week (or $35,568 per year) $1,043 per week for the motion picture producing industry. The new rule also increases the salary level for “highly compensated employees” to $107,431. Additional information is available here.

—

For further information, please contact Compliance@castandcrew.com.

The proceeding information is provided for informational purposes only, should not be construed as or relied upon as legal advice and is subject to change without notice. If you have questions concerning particular situations, specific payroll administration or labor relations issues, please contact your counsel.