THE INCENTIVES PROGRAM - TIP

A first look at our newsletter.

September 05, 2023Cast & Crew Financial Services (CCFS) offers both U.S. and Canadian production incentive management services from setup to audit, as well as production incentive financing.

Join Our Mailing List

Cast & Crew on Twitter

Cast & Crew on LinkedIn

Cast & Crew on Facebook

ENACTED LEGISLATION

Signed by the Governor

On June 5, 2023, Governor Jared Polis signed House Bill 1309 into law, thereby amending the Colorado performance-based (rebate) incentive for film production in the state and establishing a film incentive tax credit for income tax years commencing on or after January 1, 2024. Details are as follows:

Film incentive tax credit

Film incentive tax credit

- Establishes a refundable tax credit equal to the following:

- 20% of qualified local expenditures if the total of such expenditures is at least $100,000 for a production company that “originates”, as defined, production activities in Colorado;

- 20% of qualified local expenditures if the total of such expenditures is at least $250,000 for a production company that produces a television commercial or video game and does not “originate” production activities in Colorado but employs a workforce made up of at least 50 percent residents for any in-state production activity;

- 22% of qualified local expenditures if the executive director of the office of Economic Development determines the production company meets either of the above criteria and films in a rural community, or marginalized urban center, or uses a local infrastructure;

- Allows the executive director of the office of Economic Development, the discretion to approve a tax credit in an amount that exceeds 20% or 22%;

- Limits the aggregate amount of tax credits that may be awarded during the 2024 calendar year to $5 million;

- Qualifies the 1st $1 million of payments to each resident and nonresident if Colorado income tax is withheld or paid by either the production company or the individual;

- Requirements:

- Meet the minimum spend as defined above;

- Employ a workforce made up of at least 50 percent Colorado residents for the in-state production activities; and,

- Establishes a sunset date of December 31, 2034.

- Amends the resident workforce requirement date range provision from on or after July 1, 2012, to on or after July 1, 2012, but before January 1, 2024, and on or after January 1, 2025; and,

- Stipulates that a production company may not apply for or receive a performance-based incentive for any qualified local expenditures for which the production company has applied for an income tax credit.

On May 19, 2023, Governor Greg Gianforte signed Senate Bill 27 into law, thereby amending the Montana Media Production tax credit program as follows:

On May 19, 2023, Governor Greg Gianforte signed Senate Bill 550 into law, thereby amending the Montana Media Production tax credit program by changing the loan out withholding rate from 6.9% to the highest marginal rate in effect under 15-30-2103.

This Act is effective January 1, 2024.

- Extends the due date for the submission of a production expenditure verification report for a project with a base investment of more than $350,000, as follows:

- From within 60 days of the completion of principal photography or, for a production for which expenditures will be claimed for multiple tax years, by the end of the tax year for which the credit will be claimed, to by the last day of the third year following the year in which principal photography ended; or for a production for which expenditures will be claimed for multiple tax years:

- Annually, if the production company chooses to submit production expenditures and compensation paid within each year; or

- By the last day of the third year following the year in which principal photography ended; and,

- From within 60 days of the completion of principal photography or, for a production for which expenditures will be claimed for multiple tax years, by the end of the tax year for which the credit will be claimed, to by the last day of the third year following the year in which principal photography ended; or for a production for which expenditures will be claimed for multiple tax years:

- Stipulates that the fee associated with the submission of cost information must be paid with each submission of production expenditures and compensation paid report.

On May 19, 2023, Governor Greg Gianforte signed Senate Bill 550 into law, thereby amending the Montana Media Production tax credit program by changing the loan out withholding rate from 6.9% to the highest marginal rate in effect under 15-30-2103.

This Act is effective January 1, 2024.

On May 3, 2023, Governor Kathy Hochul signed Assembly Bill 3009 and Senate Bill 4009 into law, thereby amending the empire state film production credit and postproduction credit, as follows:

- Increases empire state film production credit from 25% to 30%;

- Increases the postproduction only credit from 25% to 30% of qualified postproduction costs at a qualified postproduction facility located within the metropolitan commuter transportation district (MCTD), and increases the postproduction only credit from 30% to 35% of qualified postproduction costs at a qualified postproduction facility located outside the MCTD;

- Increases funding, beginning January 1, 2024, to $700 million per calendar year and allocates $45 million of such funding to the postproduction only program;

- Allows up to $500,000 of wages, salaries, or other compensation per individual for writers, directors, composers, and performers (other than background actors with no scripted lines) to qualify for the incentive;

- Allows up to $500,000 of wages, salaries, or other compensation per producer, for up to two producers to qualify, provided that the producers are not compensated for any other position on the qualified film;

- Limits the aggregate total eligible qualified production costs constituting wages, salaries or other compensation, for writers, directors, composers, producers, and performers to not more than 40% of the aggregate sum total of all other qualified production costs;

- Reduces the time an applicant must wait to claim the tax credit by allowing the credit to be claimed in the taxable year that includes the allocation year rather than the year after the allocation year;

- Reduces the number of years from five to two years that a variety or talk show must film outside New York prior to its first relocated season in New York, in order to qualify as a “relocated television production”;

- Modifies the additional 10% upstate county labor credit so that it includes wages, salaries or other compensation, for writers, directors, composers, producers, and performers but limits the aggregate total of such wages to not more than 40% of the aggregate sum total of all other qualified production costs;

- Establishes a credit equal to 10% of “qualified production costs” (excluding wages, salaries, or other compensation) paid or incurred for property used and services performed in an upstate county, provided the qualified film:

- Has a minimum budget of $500,000; and,

- Shoots the majority of principal photography in any of the specified upstate counties;

- Eliminates the $5 million aggregate credit cap on upstate county labor;

- Allows up to $6 million of relocation costs (excluding wages, salaries and other compensation) in the first season that an eligible relocated television series, as defined, relocates to New York;

- Extends sunset date for the film and postproduction programs thru December 31, 2034; and,

- Extends the sunset date for the commercial production program thru December 31, 2028.

IN THE NEWS

- Arkansas - State Senators clarify film incentive focus, say special session for tax cuts floating (August 27, 2023)

- Australia - City of Gold Coast ramp up screen investment with new film commission, studio plans (August 29, 2023)

- New Mexico - New Mexico lawmakers consider how to keep growing film industry (August 30, 2023)

Production Incentives

Joe Bessacini

Vice President, Film & TV Production Incentives 661.492.3530 joe.bessacini@castandcrew.comIncentive Financing

Deirdre Owens

Vice President, Production Incentive Financing 818.972.3201 deirdre.owens@castandcrew.comALBUQUERQUEATLANTABATON ROUGEBURBANKLONDONNEW YORKTORONTOVANCOUVER

IN THIS ISSUE

ENACTED

IN THE NEWS

LOOKING FOR AN OLD NEWSLETTER?

QUICK LINKS

Production Incentives

Joe Bessacini

Vice President, Film & TV Production Incentives 661.492.3530 joe.bessacini@castandcrew.comIncentive Financing

Deirdre Owens

Vice President, Production Incentive Financing 818.972.3201 deirdre.owens@castandcrew.comALBUQUERQUEATLANTABATON ROUGEBURBANKLONDONNEW YORKTORONTOVANCOUVER

Copyright © 2024. All Rights Reserved.

Cast & Crew Financial Services

Cast & Crew Financial Services

Production Incentives Map and Comparison Tool

Production Incentives Map and Comparison Tool

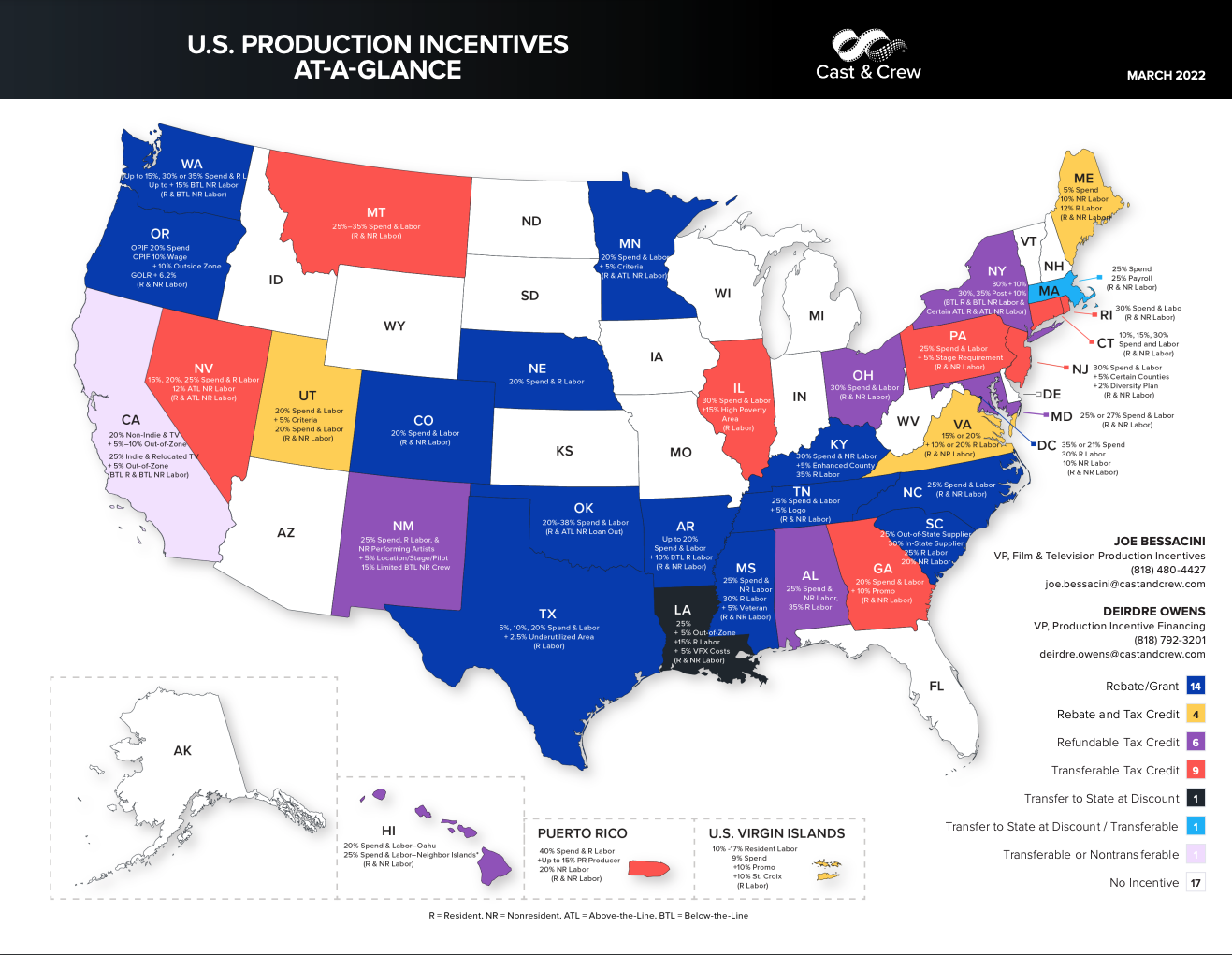

U.S. At-A-Glance Map

U.S. At-A-Glance Map

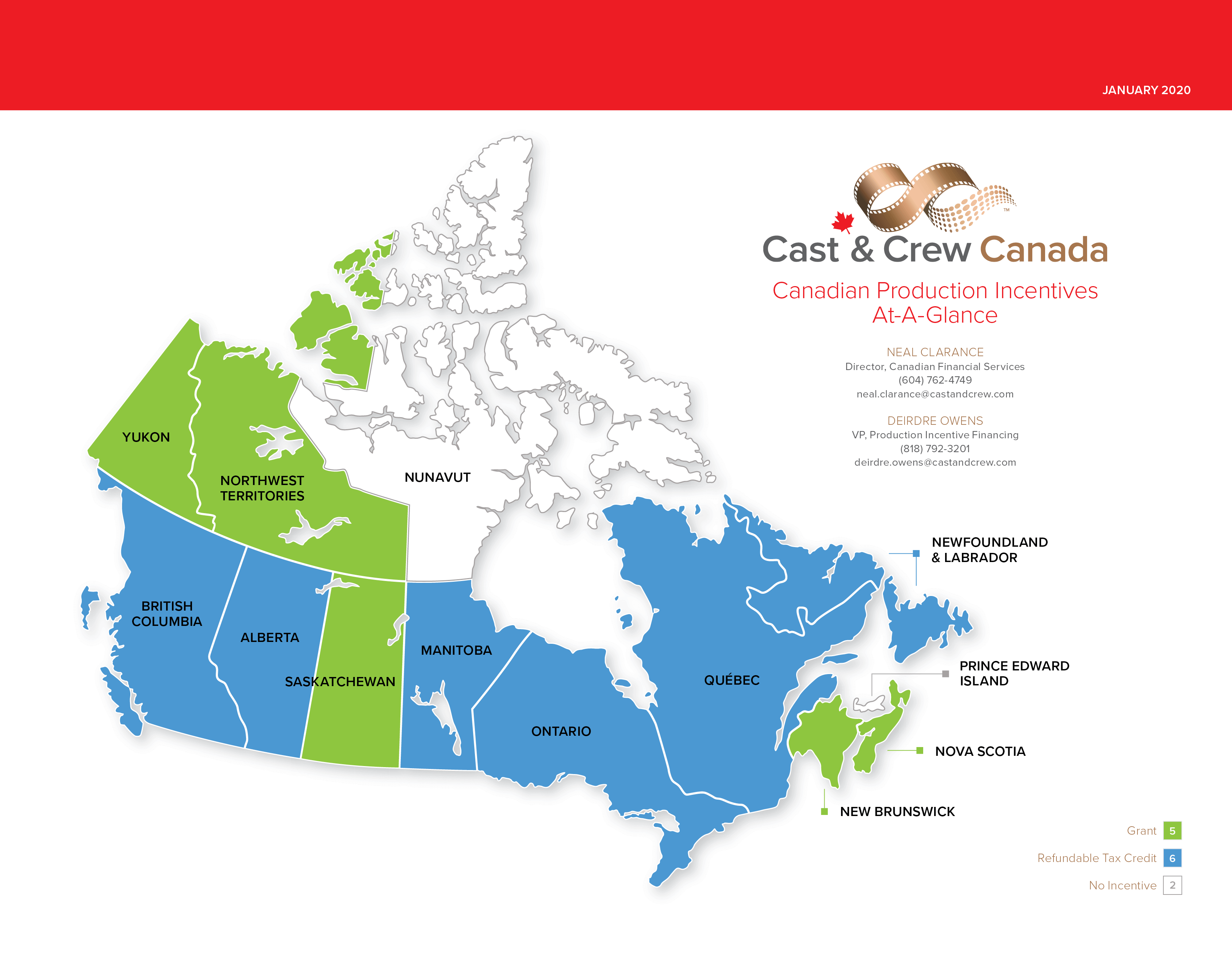

Canada At-A-Glance Map

Canada At-A-Glance Map

TIP Guide

TIP Guide