THE INCENTIVES PROGRAM - TIP

A first look at our newsletter.

August 01, 2023Cast & Crew Financial Services (CCFS) offers both U.S. and Canadian production incentive management services from setup to audit, as well as production incentive financing.

Join Our Mailing List

Cast & Crew on Twitter

Cast & Crew on LinkedIn

Cast & Crew on Facebook

ENACTED LEGISLATION

Signed by the Governor

On June 14, 2023, Governor Kay Ivey signed Senate Bill 299, which amends the Entertainment Industry Incentive Act of 2009 by establishing a sunset date of December 31, 2028.

On May 30, 2023, Governor Jared Polis signed House Bill 1275 into law, thereby amending the Colorado performance-based incentive for film production program as follows:

- Specifies that payments made to each loan out company, up to one million dollars per calendar year, may be considered qualified local expenditure if the production company that makes the payment files an information return in a form prescribed by the Department of Revenue; and,

- Requires production companies to deduct and withhold state income tax from payments made to a loan out company, at the rate set forth in Section 39-22-104 OR 39-22-301, only if the loan out company:

- Fails to provide a validated taxpayer identification number; or

- Provides an IRS issued taxpayer identification number for nonresident aliens.

On June 15, 2023, Governor John Bel Edwards signed House Bill 562 into law, thereby amending the Louisiana motion picture production tax credit for applications submitted on or after July 1, 2023.

- Eliminates the option to make a donation to a Louisiana nonprofit film grant program as a condition to receive the tax credits;

- Requires the expenditure verification report to include a listing of all Louisiana expenditures including the date of the expenditure, the vendor's address including the zip code, and the amount of the expenditure;

- Eliminates the requirement to reserve a portion of the annual program cap for qualified entertainment companies, Louisiana screenplay productions, and independent productions; and,

- Extends the sunset date to June 30, 2031.

On May 8, 2023, Governor Wes Moore signed Senate Bill 452 into law, thereby amending the Maryland Film Production Activity Tax Credit program as follows:

- Expands the definition of eligible projects to include a documentary, or a talk, reality, or game show;

- Modifies the definition of direct costs to include the salaries, wages, or other compensation for writers, directors, or producers;

- Increases the tax credit rate to be applied to direct costs from:

- 27% to 30% for a television series;

- 25% to 28% for a Maryland small or independent film entity, not to exceed a tax credit of $125,000; and

- 25% to 28% for all other types of productions;

- Increases the program’s funding for each fiscal year (7/1 - 6/30), as follows:

- 2023 - $12 million;

- 2024 - $15 million;

- 2025 - $17.5 million;

- 2026 - $20 million; and,

- 2027 and each fiscal year thereafter, $12 million.

On July 6, 2023, Governor Mike Parson signed Senate Bill 94 into law, thereby reenacting the tax credit program for qualified motion media projects and creating a new program for music rehearsals and touring. Details of the programs are below.

Motion Picture Media Projects

Music Rehearsals and Touring

Motion Picture Media Projects

- Creates a transferable base tax credit equal to 20% of qualifying expenses;

- Allows for the total dollar amount of tax credits to be increased by 10% for projects located in a county of the second, third, or fourth class;

- Allows for the opportunity to earn additional credits as follows:

- 5% of qualified expenditures if at least 50 percent of the project is filmed in Missouri;

- 5% of qualified expenditures if at least 15 percent of the project that is filmed in Missouri takes place in a rural or blighted area in Missouri;

- 5% of qualified expenditures if at least three departments hire Missouri residents in specialized craft or learn new skillset;

- 5% of qualified expenditures if script positively markets Missouri or a Missouri tourist attraction;

- Limits the amount of credits that may be authorized per year as follows:

- $8 million for all film production;

- $8 million for all series production;

- Qualifies compensation and wages paid by the production company to residents and nonresidents on which the production company remitted withholding payments;

- Qualifying compensation and wages paid to all above-the-line individuals is limited to 25 percent of overall qualifying expenses;

- Requirements:

- Employ at least the following number of Missouri registered apprentices or veterans residing in Missouri with transferable skills when qualifying expenses are:

- less than $5 million, two;

- at least $5 million but less than $10 million, three;

- at least $10 million but less than $15 million, six; or,

- at least $15 million, eight;

- Submit final application along with an economic impact statement accompanied by verification of expenses by a certified public accountant located and licensed in Missouri;

- Feature a statement and logo in the credits of the completed production indicating that the project was filmed in Missouri;

- Meet the minimum qualifying spend requirements of $50,000 for a project under thirty minutes or $100,000 for a project greater than 30 minutes; and,

- Employ at least the following number of Missouri registered apprentices or veterans residing in Missouri with transferable skills when qualifying expenses are:

- Establishes a sunset date of December 31, 2029.

Music Rehearsals and Touring

- Creates a transferable tax credit equal to 30% of qualifying rehearsal and tour expenses;

- Limits the aggregate amount of tax credits that may be authorized in a given fiscal year (7/1 – 6/30) to $8 million;

- Limits the taxpayer’s fiscal year tax credit as follows:

- For a base investment of less than $4 million, the maximum credit is $1 million;

- For a base investment of $4 million but less than $8 million, the maximum credit is $2 million;

- For a base investment of $8 million or more, the maximum credit is $3 million;

- Qualifies the total amount expended on salaries paid to resident employees, whether working within or outside of Missouri, or nonresident employees working within Missouri;

- Requirements:

- Spend at least $1 million in purchases or rental of concert tour equipment, related services, or both from a Missouri vendor for use in the rehearsal, on the tour, or both;

- Have a rehearsal at a qualified rehearsal facility, as defined, for a minimum of ten days; and

- Hold at least two concerts in the state of Missouri; and

- Establishes a sunset date of December 31, 2030.

On June 23, 2023, Governor Daniel McKee signed House Bill 5801 and Senate Bill 464 into law, thereby amending the Rhode Island musical and theatrical production tax credit program as follows:

- Amends the definition of an accredited theater production to include a national touring production;

- Defines national touring production as a live stage production that, in its original or adaptive version, is performed in a qualified production facility and opens its U.S. tour in Rhode Island with a minimum of at least four (4) public performances and following the production's final performance in Rhode Island, the national touring production must perform for at least four (4) weeks in at least four (4) cities outside of Rhode Island; and,

- Extends the musical and theatrical production program’s sunset date to June 30, 2027.

On May 18, 2023, Governor Bill Lee signed House Bill 1545, appropriating $8 million to the Tennessee Film and Television Incentive Fund for the 2024 fiscal year (7/1 - 6/30).

On June 12, 2023, Governor Greg Abbott signed House Bill 4539, thereby amending the moving image industry incentive program by reducing the required amount of Texas resident workers from 70% to 55% of paid production crew, actors, and extras.

This act takes effect September 1, 2023.

On June 18, 2023, and June 9, 2023, Governor Greg Abbott signed House Bill 1 and Senate Bill 30, which appropriates $45 million and $155 million, respectively, to the Texas Moving Image Industry Incentive Program for the biennium ending 8/31/2025.

This act takes effect September 1, 2023.

On June 18, 2023, and June 9, 2023, Governor Greg Abbott signed House Bill 1 and Senate Bill 30, which appropriates $45 million and $155 million, respectively, to the Texas Moving Image Industry Incentive Program for the biennium ending 8/31/2025.

IN THE NEWS

- California - Production Alert Application Windows, Labor Disruption, Soundstage Filming Program Changes (July 17, 2023)

- Czech Republic - Czech Film Commissioner On Restructuring The Countrys Production Incentive & Managing The “Huge” International Demand To Shoot In The Country — KVIFF ( June 30, 2023)

- Georgia - How the TV & film tax credit turned Georgia into Hollywood of the South (July 25, 2023)

Production Incentives

Joe Bessacini

Vice President, Film & TV Production Incentives 661.492.3530 joe.bessacini@castandcrew.comIncentive Financing

Deirdre Owens

Vice President, Production Incentive Financing 818.972.3201 deirdre.owens@castandcrew.comALBUQUERQUEATLANTABATON ROUGEBURBANKLONDONNEW YORKTORONTOVANCOUVER

IN THIS ISSUE

ENACTED

IN THE NEWS

LOOKING FOR AN OLD NEWSLETTER?

QUICK LINKS

Production Incentives

Joe Bessacini

Vice President, Film & TV Production Incentives 661.492.3530 joe.bessacini@castandcrew.comIncentive Financing

Deirdre Owens

Vice President, Production Incentive Financing 818.972.3201 deirdre.owens@castandcrew.comALBUQUERQUEATLANTABATON ROUGEBURBANKLONDONNEW YORKTORONTOVANCOUVER

Copyright © 2024. All Rights Reserved.

Cast & Crew Financial Services

Cast & Crew Financial Services

Production Incentives Map and Comparison Tool

Production Incentives Map and Comparison Tool

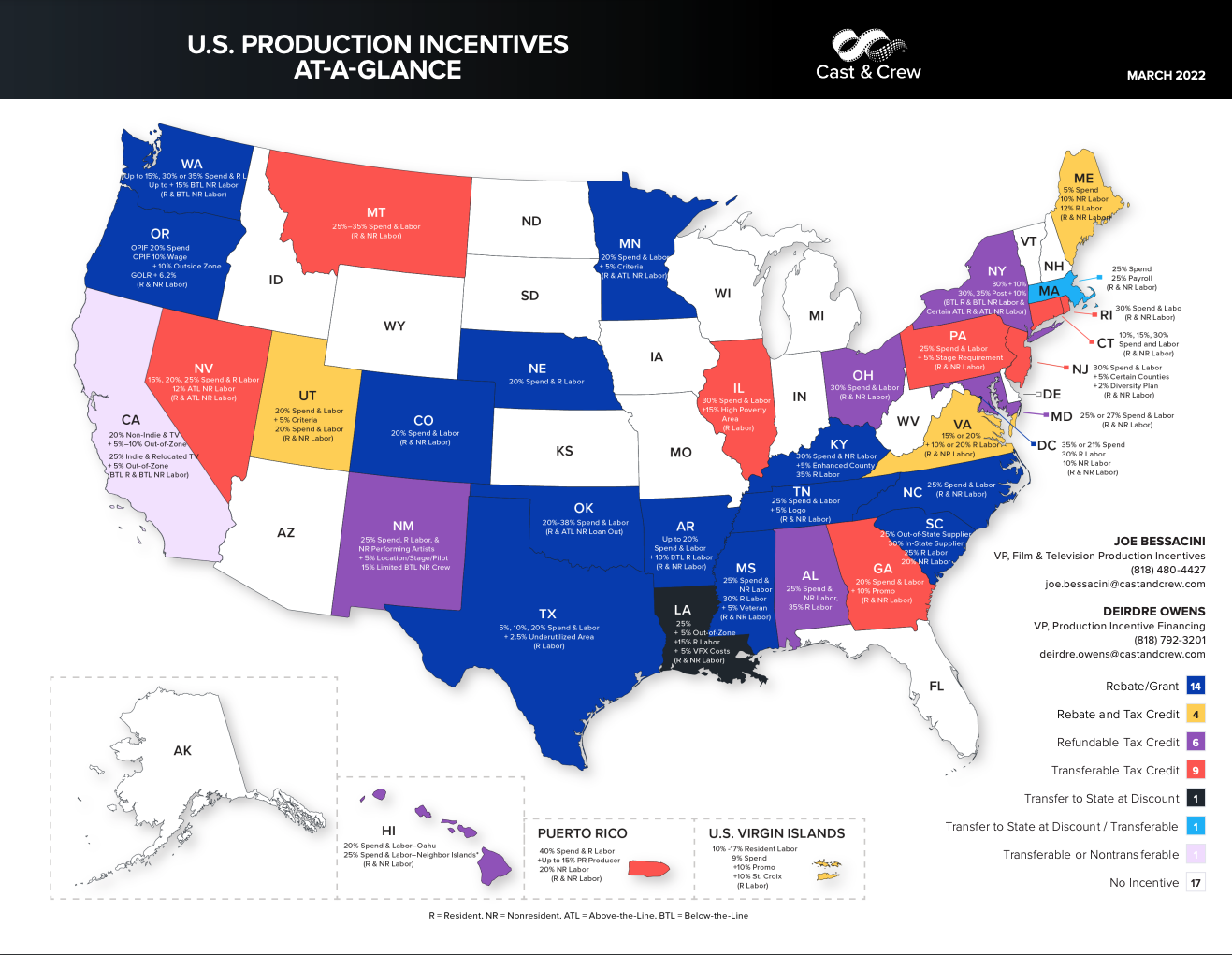

U.S. At-A-Glance Map

U.S. At-A-Glance Map

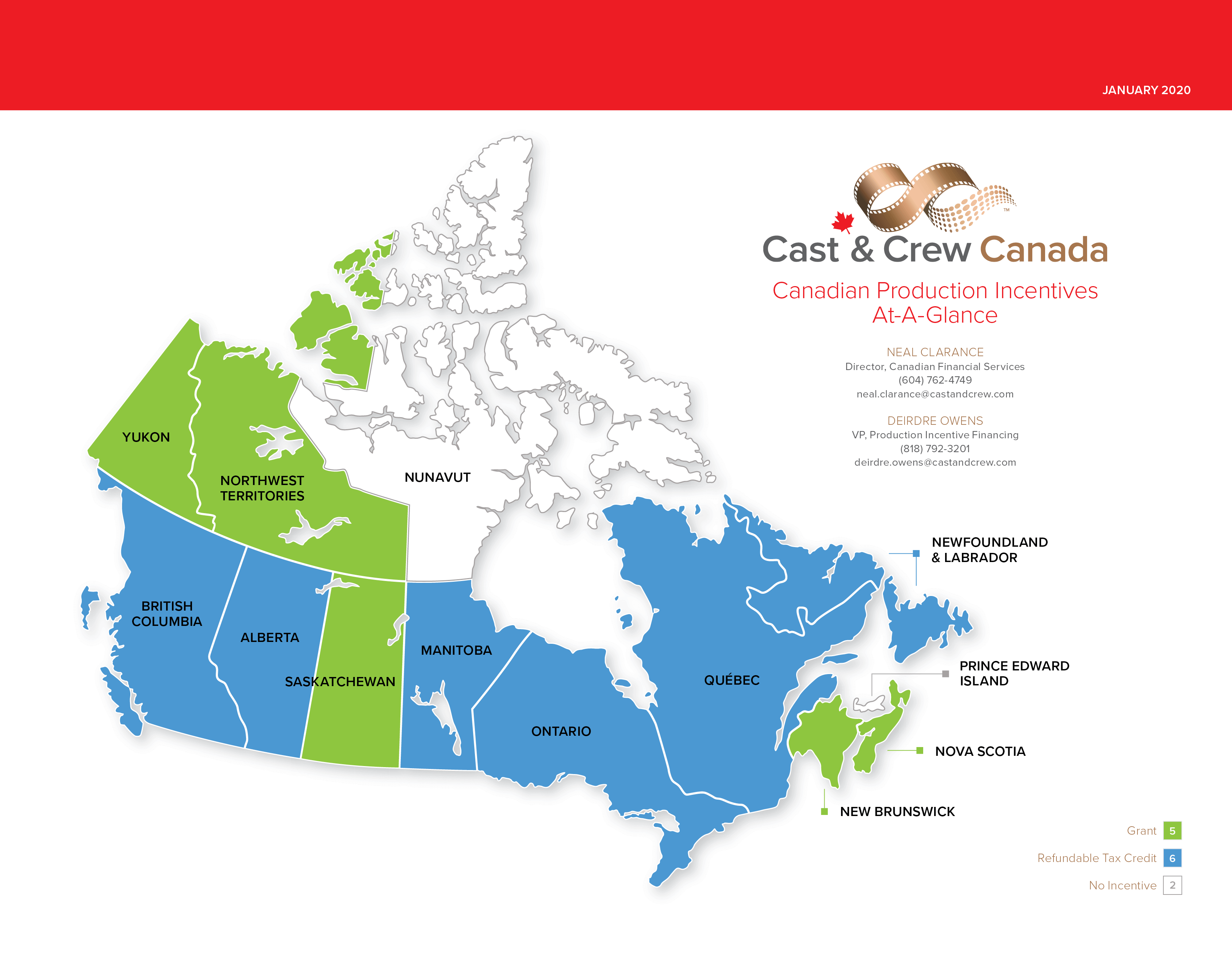

Canada At-A-Glance Map

Canada At-A-Glance Map

TIP Guide

TIP Guide