THE INCENTIVES PROGRAM - TIP

A first look at our newsletter.

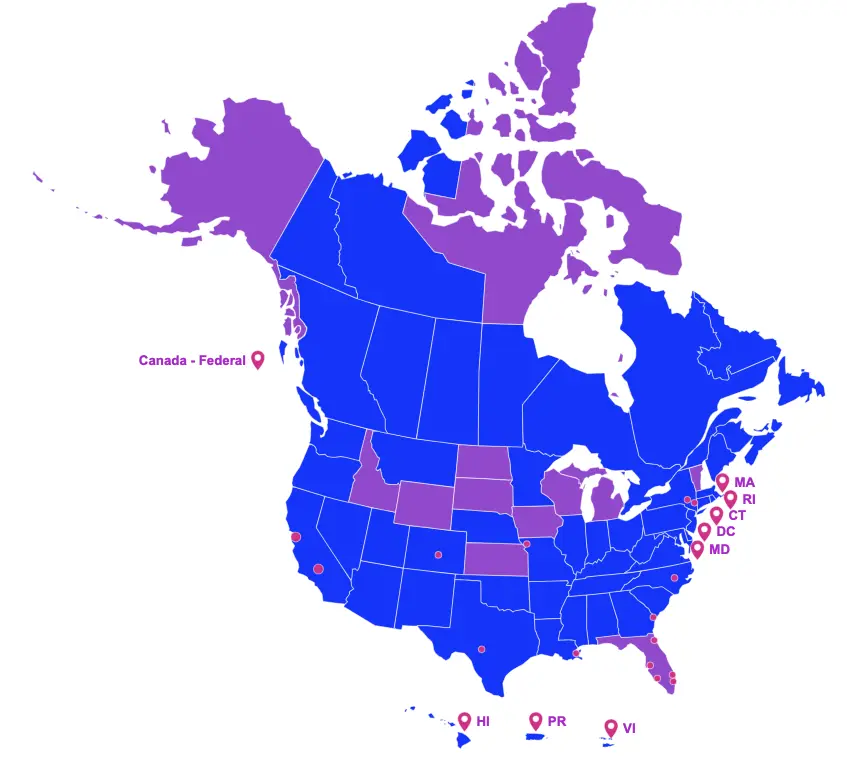

Cast & Crew Financial Services (CCFS) offers both U.S. and Canadian production incentive management services from setup to audit, as well as production incentive financing.

ENACTED LEGISLATION

Signed by the Governor

Colorado (H 1285)

On June 14, 2021, Governor Jared Polis signed House Bill 1285 that appropriates $5 million to the Colorado Film, Television, and Media performance-based incentive program and an additional amount up to $1 million, which brings the total available funds (including rollovers from prior years) to $9.25M for fiscal year 2022.

Nevada (A 20)

On May 25, 2021, Governor Steve Sisolak signed Assembly Bill 20, which amends Nevada’s Transferrable Tax Credits for Film and Other Productions as follows:

- Eliminates the minimum episode requirement for reality television projects to qualify, previously six or more episodes were required;

- Allows qualified expenditures incurred prior to the submission date of the application to be included in the claim for the transferable tax credit;

- Requires a film office approved Nevada end credit logo or another form of acknowledgement that indicates the production was filmed or produced in Nevada;

- Extends the time to submit the audit by an approved independent CPA from 90 days to 270 days after the completion of principal photography or postproduction, if postproduction costs were incurred in-state;

- At the discretion of the Office of Economic Development, a 90-day extension may be granted; and,

- Allows the credit to be withheld if the production company violates any state or local law or if a production company submitted any false, statement, representation, or certification in any document submitted for the purposes of obtaining the credit.

The Act shall become effective July 1, 2021.

North Carolina (S 105)

On November 18, 2021, Governor Roy Cooper signed Senate Bill 105, which modifies The Film and Entertainment Grant and establishes The Esports Industry Grant program as follows:

Film and Entertainment Grant

- Reduces the minimum qualified spend requirement to:

- $1,500,000 for a feature length film made for theatrical viewing;

- $500,000 for a movie made for television;

- $500,000 per episode for a television series;

- $250,000 for a commercial for theatrical or television viewing, or online distribution;

- Modifies the per project incentive cap as follows:

- $7,000,000 for feature film;

- $15,000,000 for single season of television series;

- $250,000 for a commercial;

Esports Industry Grant Fund

- Creates a grant program equal to 25% of qualified expenditures;

- Establishes a funding cap of $5,000,000 per fiscal year;

- Limits qualified compensation to the first $1m paid to each worker;

- Approves projects based on economic benefit to state;

- Requirements:

- Minimum qualified spend of $250,000;

- Compliance audit by independent certified public accountant licensed in NC; and,

- Include promotional logo approved by Department of Commerce.

The Act shall take effect November 18, 2021.

Oregon (H 2433)

On July 19, 2021, Governor Kate Brown signed House Bill 2433, which amends the Oregon Production Investment Fund program as follows:

- Increases the annual funding cap from $14 million to $20 million per fiscal year (7/1 – 6/30); and,

- Extends the program’s sunset date from December 31, 2024 to December 31, 2029.

The Act shall take effect July 1, 2021.

Oregon (H 3010)

On June 11, 2021, Governor Kate Brown signed House Bill 3010, which adds the following diversity and harassment requirements to the Oregon Production Investment Fund program:

- Have a written diversity, equity, and inclusion policy at the time the application is submitted;

- Actively engage in good faith efforts to hire or contract with individuals from underrepresented groups;

- Report the project’s diversity statistics to the Oregon Film and Video Office after completion of the production; and,

- Establish a process for addressing claims of harassment, discrimination and other misconduct related to production.

Rhode Island (H 6122)

On July 6, 2021, Governor Daniel McKee signed House Bill 6122, thereby increasing the annual funding for the motion picture and musical and theatrical tax credits to $30 million BUT only for the 2022 calendar year. The funding for calendar year 2021 remains at $20 million.

Tennessee (S 912)

On May 17, 2021, Governor Bill Lee signed Senate Bill 912, which appropriates $2 million to the Tennessee Film and Television Incentive Fund, for the 2022 fiscal year (July 1 – June 30).

Texas (S 1)

On June 18, 2021, Governor Greg Abbott signed Senate Bill 1, which appropriates $45 million to the Texas Moving Image Industry Incentive Program for the biennium ending 8/31/2023.