THE INCENTIVES PROGRAM - TIP

A first look at our newsletter.

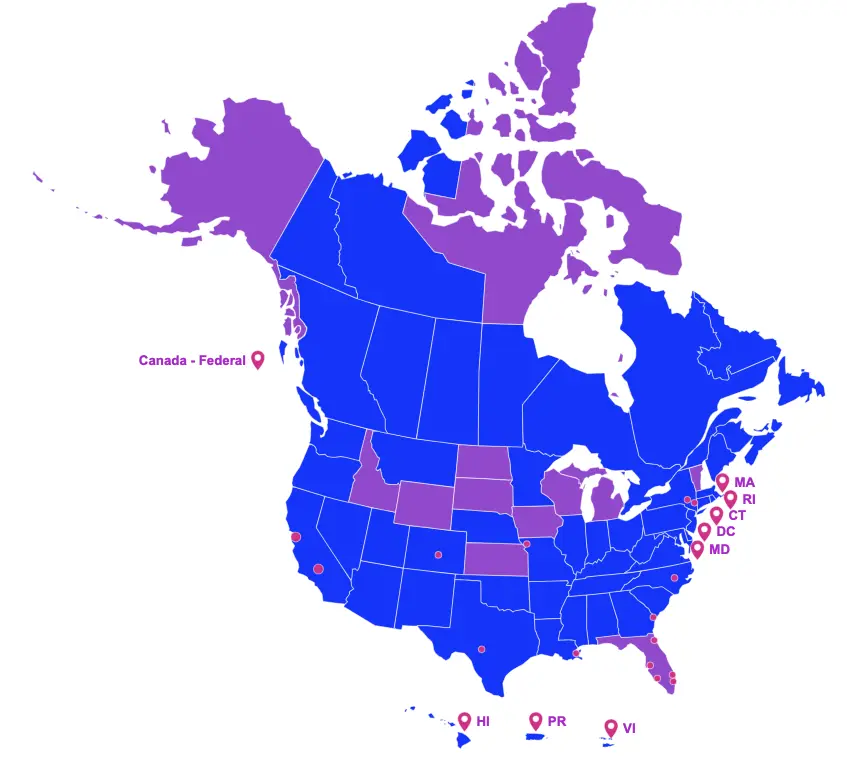

Cast & Crew Financial Services (CCFS) offers both U.S. and Canadian production incentive management services from setup to audit, as well as production incentive financing.

ENACTED LEGISLATION

Signed by the Governor

Tennessee (H 141) and (S 736)

On March 29, 2021, Governor Bill Lee signed House Bill 141 and Senate Bill 736, which amends the Tennessee Job Tax Credit as follows:

- Establishes a tax credit (to be taken against franchise and excise taxes) equal to 40 per cent of qualified payroll expenses, or 50% if qualified payroll expenses are associated with Tennesseans whose primary residence is within tier 2, tier 3, tier 4 enhancement counties;

- Limits the amount of the credit to not more than 50% of the combined franchise and excise tax liability shown on the return before any credit is taken; and,

- Creates a sales and use tax exemption for purchasing or using tangible personal property, computer software, or services that are necessary to and primarily used for a qualified production.

This Act shall take effect July 1, 2021.

PROPOSED LEGISLATION

Still in the House or Senate

California (S 51) and (S 313)

Senate Bill 51 and 313 propose to amend the California Competes tax credit as follows:

- Allows a “qualified taxpayer” to claim a refundable tax credit, in an amount as provided in a written agreement between the Governor’s Office of Business and Economic Development and the taxpayer;

- Defines a “qualified taxpayer” as one that has created at least 5,000 prevailing wage, full-time or full-time equivalent jobs in the state each year for a period of 10 years; and,

- Requires a qualified taxpayer that receives a refund to reinvest the refund into immobile capital equipment that supports infrastructure improvements, expansion, or developments for media production facilities in California;

If signed, the Act shall take effect January 1, 2022.

California (S 611)

Senate Bill 611 proposes to amend the California film tax credit program as follows:

- Allows the film commission to increase the jobs ratio of a qualified motion picture by up to (a percentage to be determined), if the production pays in excess of (a percentage to be determined) of its total qualified wages to the following:

- Qualified individuals who have completed participation in a career pathways program or an equivalent program approved by the California Film Commission; or,

- Qualified individuals who are assistant directors who have completed a training program substantially equivalent to a career pathways program that has been approved by the California Film Commission.

If signed, the Act shall take effect for applications filed on or after January 1, 2022.

California (A 986)

Assembly Bill 986 proposes to amend the California Film tax credit program as follows:

- Establishes a transferrable tax credit equal to 40 percent of qualified expenditures for independent minority films with an opportunity earn additional credits;

- Defines independent minority films as follows:

- A motion picture, as defined, with a minimum budget of $1 million;

- Produced by a company that is not publicly traded, is at least 51 percent owned by a minority individual or group, and whose management and daily business operations are controlled by at least one individual that is a minority;

- Hires minority group members in at least 50 percent of the following positions:

- Writers, directors, music directors, music composers, music supervisors, producers, performers, other than background actors with no scripted lines, and behind-the-camera roles, including, but not limited to, lighting, sound, cameras, and design;

- Defines “minority” as African American, Asian Pacific American, Hispanic American (Caribbean, Central or South American, Cuban, Mexican, or Puerto Rican), or Native American (having origin in any of the original peoples of North America or the Hawaiian Islands);

- Allows the incentive to be earned on up to $30 million in qualified expenditures for each independent minority film;

- Increases the annual funding cap for the program by $200 million, for a total of $530 million per fiscal year (7/1 – 6/30) thru fiscal year 2025;

- Only independent minority films may draw funds from the $200 million pool and, when depleted, draw from the $330 million pool; and,

- Includes the City of Banning, CA within the Los Angeles zone.

If signed, the Act shall take effect July 1, 2021.

Minnesota (H 2079) and (S 2190)

House Bill 2079 and Senate Bill 2190 propose to allocate $500,000 per fiscal year (7/1 – 6/30) for the biennium ending June 30, 2023.

Montana (H 340)

House Bill 340 proposes to amend the Montana Economic Development Industry Advancement Act Film Tax Incentives program as follows:

- Increases the incentive that may be earned on above-the-line compensation from 20 percent to 25 percent;

- Increases the amount of compensation that may qualify for each above-the-line worker (resident or nonresident, as long as Montana income taxes were withheld) from $7.5 million to $10 million;

- Eliminates the annual funding cap, previously limited to $10 million per calendar year;

- Allows non-scripted and streaming projects to qualify;

- Extends the deadline for submitting a claim from 60 days to 90 days from completion of principal photography; and,

- Extends the qualifying period from six months to one year before the state certification date.

If signed, this Act shall take effect retroactively to January 1, 2020.

New York (S 5537)

Senate Bill 5537 proposes to amend the Empire State Film Postproduction Credit program as follows:

- For purposes of determining a project’s eligibility for the postproduction only program, out-of-state postproduction labor expenses shall be incorporated into the calculation of total qualified postproduction costs if the performance of services outside the state are on behalf of a project contracted with a qualified postproduction facility and whose projects are taxable by the state.

Texas (H 2418)

House Bill 2418 amends the Texas Moving Image Industry Incentive Program (MIIIP) and establishes the Moving Image Production Facility Incentive Program as follows:

Texas Moving Image Industry Incentive Program (MIIIP):

- Codifies the amount of the grant as follows:

- 5 percent of in-state spending for a qualifying production that spends at least $250,000 but less than $1 million on the project;

- 10 percent of in-state spending for a qualifying production that spends at least $1 million but less than $3.5 million on the project; or,

- 20 percent of in-state spending for a qualifying production that spends $3.5 million or more on the project;

- Allows an additional 2.5 percent of the total amount of in-state spending if at least 50 percent of the cast and crew are from diverse backgrounds (as defined by Rule);

- Increases the additional grant for filming at least 25 percent of principal photography days in an underutilized and economically distressed area from 2.5 percent to 7.5 percent;

- Eliminates the requirement that at least 60 percent of principal photography days take place in Texas;

- Appears to allow both resident and nonresident labor to qualify up to $1 million for each worker; and,

- Waives the requirement to submit a grant application for production companies that meet the qualification requirements at a production facility located in Texas that is owned by the company or a parent, subsidiary, or affiliate of the company.

Moving Image Production Facility Incentive Program:

- Creates a grant equal to 10 percent or 20 percent of in-state facility construction spending for production companies that spend at least $2 million, but less than $4 million, and more than $ 4 million, respectively;

- Allows for an additional grant equal to 7.5 percent of in-state facility construction spending if the production company constructs such facility in an underutilized and economically distressed area;

- Allows for an additional grant equal to 2.5 percent of in-state facility construction spending if:

- The production company constructs the facility to produce projects with a primary focus on persons from diverse ethnic backgrounds; and,

- At least 25 percent of the persons employed at the facility are from diverse ethnic backgrounds; and,

- Requires the production company be a limited liability company, partnership, or corporation formed or organized in Texas, or, a joint venture or other legal entity in which one entity that holds at least a 30 percent ownership interest is a limited liability company, partnership, or corporation formed or organized in Texas.

If passed, the Act shall take effect September 1, 2021.

Texas (H 2854)

House Bill 2854 proposes to establish the Texas Film and Entertainment Industry Incentive Program (MIIIP) as follows:

Production Facility Grant:

- Creates a grant equal to the following:

- 10 percent of in-state construction costs if the production company spent at least $2.5 million but less than $5 million on the facility;

- 20 percent of in-state construction costs if the production company spent at least $5 million but less than $10 million on the facility; and,

- 25 percent of instate construction costs if the production company spent at least $10 million.

- Allows for an additional grant equal to 5 percent of in-state construction spending if the production facility is constructed in an underutilized and economically distressed area;

- Requirements:

- Spend a minimum of $2.5 million in constructing a production facility in Texas;

- Employ at least 15 full-time employees who are residents;

- Show that at least 80 percent of all services used in the design and construction of the production facility were provided by businesses with their principal place of business in Texas; and,

- Register to be a Texas limited liability company, partnership, or corporation, or, one that holds at least a 30 percent ownership in a joint venture or other legal entity.

Project Production Grant:

- For film and television projects, creates a grant equal to the following:

- 10 percent of in-state spending on the project if the production company spent at least $250,000 but less than $1 million on the project;

- 20 percent of in-state spending on the project if the production company spent at least $1 million but less than $3.5 million on the project; and,

- 30 percent of in-state spending on the project if the production company spent at least $3.5 million on the project.

- For digital interactive media projects, creates a grant equal to the following:

- 10 percent of in-state spending on the project if the production company spent at least $100,000 but less than $1 million on the project;

- 20 percent of in-state spending on the project if the production company spent at least $1 million but less than $3.5 million on the project; and,

- 30 percent of in-state spending on the project if the production company spent at least $3.5 million on the project.

- For reality-based television projects, creates a grant equal to the following:

- 10 percent of in-state spending on the project if the production company spent at least $250,000 but less than $1 million on the project; and,

- 20 percent of in-state spending on the project if the production company spent at least $1 million on the project.

- For a commercial, educational or instructional video, or visual effects project, creates a grant equal to the following:

- 10 percent of in-state spending on the project if the production company spent at least $100,000 but less than $1 million on the project; and,

- 20 percent of in-state spending on the project if the production company spent at least $1 million on the project.

- Allows an additional grant equal to 5 percent of the production company’s in-state spend if the project is produced in an underutilized and economically distressed area;

- Requirements:

- Film at least 60 percent of principal photography days in Texas; and,

- See that at least 70 percent of the paid production crew, actors, and extras are residents.

If signed, this Act shall take effect September 1, 2021.